Forget trying to invest — if you have “bad debt” (credit card, payday loans) on your plate, your main priority should be getting rid of that. Unlike “good debt,” like a mortgage, these types of debt aren’t backed by assets and tend to charge excessively high interest rates.

Once you have bad debt cleared and an ample six-month minimum emergency fund saved up, then you can safely consider investing money. My preferred approach with this is via a broadly diversified, low-cost, passively managed exchange-traded fund, or ETF. Why is this?

Well, I don’t like betting on individual stocks. Sure, I could strike it rich. I could also lose all my money. With an index fund, I’ll match the market’s average return — less some small fees. There’s nothing wrong with average; coupled with good financial behaviours, it could result in a rich payout. Let’s use a historical example.

The power of compounding

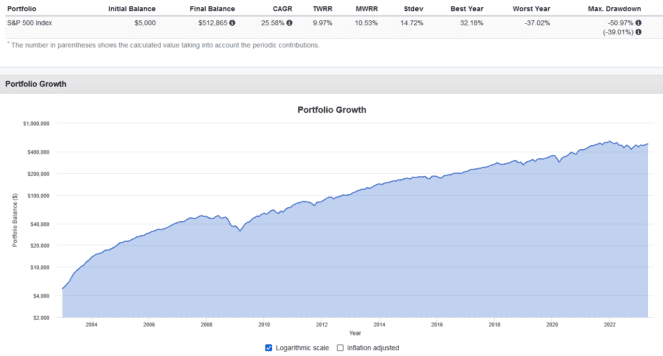

Here are some ground rules for our historical simulation: the year is 2003. I’m a 30-year-old with $5,000 saved up to invest. Every month, I’m committing to investing $500 in a low-cost index ETF tracking the S&P 500. I will not panic-sell or try to time the market. I will reinvest all dividends received promptly.

Here’s what the results look like by April of 2023:

Our initial $5,000 investment plus monthly $500 contributions grew to $512,865 in 20 years, despite bad market crashes in 2008 and 2020, and down years in 2018 and 2022. That’s the power of compounding at play.

The results would have been even more spectacular had you invested more initially or upped the size of your monthly contributions. Instead of fretting about which investments to pick, consider targeting these factors instead!

ETFs to use

Our goal for which ETF to use with this passive investing strategy should be focused on two primary considerations: broad diversification and low fees. The ideal ETF for this in my opinion is BMO S&P 500 Index ETF (TSX:ZSP).

This ETF tracks over 500 large- and mid-cap stocks selected by the S&P Committee to be representative of the overall U.S. market. It’s diversified across all 11 market sectors and has historically been a powerhouse.

And best of all? ZSP is very low-cost, with a management expense ratio of just 0.09%. For a $10,000 investment in ZSP, you can expect to pay around $9 in annual fees. That’s chump change compared to most mutual funds.