After the most recent correction, many of your favourite dividend stocks now have yields that are the highest they’ve been in recent memory.

In 99% of cases, the businesses behind these bruised stocks are still as robust as they were four months ago, as the S&P 500 burst through all-time highs; the only difference this time around is that investor sentiment has faded, inspiring irrational selling action over macro fears that I think are blown out of proportion at this juncture.

As an investor, there will always be something out there to worry about, as there are always going to be macro uncertainties and contingent events that could derail an investment thesis. And although it seems like we’re in about to enter a recession with all these fear-inducing negative headlines in the mainstream financial media, the fact remains that we’ve just fallen into a mere correction and are actually nowhere near the bear market that everybody thinks we’re already in.

While “buying the dip” has been ineffective this time around, I’d encourage investors to consider focusing on the enhanced dividend yields that are now abundant on the TSX.

If you’re going to endure choppy waters, you might as well collect a fatter dividend payment! As fear remains the aura that’s in the air, you’ll have a timely opportunity to “lock in” your higher-than-average dividend yield — something that won’t be possible should stocks become great again through the eyes of fearful investors who were euphoric coming into the year.

So, without further ado, consider the following two dividend stocks with fatter-than-average yields that you may want to pull the trigger on before they revert back to their means.

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM)

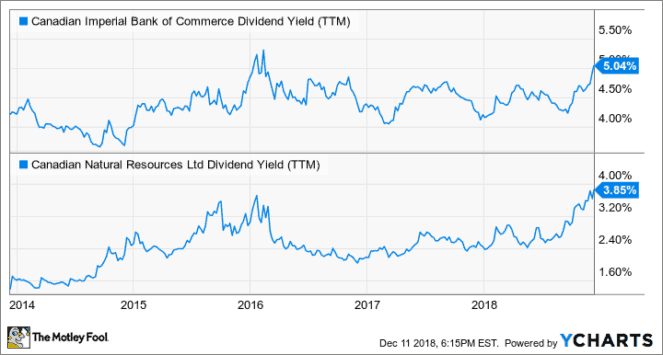

CIBC stock has lost over 14% of its value since September, causing the dividend yield to swell to 5.2%, the highest it’s been since early 2016, the last time CIBC fell into a bear market.

Now, if you didn’t lock in the +5.2% dividend yield the moment CIBC stock fell into bear territory (+20% drop from the peak), you missed the opportunity to get the higher yield because the stock was quick to recover, and the yield quickly returned back to normal levels (around 4.4%), as investors returned to their senses with the severely undervalued name.

Just have a look at the chart below, and you’ll get an idea of how brief the last time frame was to lock in the amplified dividend. An extra 0.8% in upfront yield may seem like you’re scraping the bottom of the barrel, but over the long term, factoring in consistent annual dividend growth, the extra yield will make a tonne of difference if you are a buy-and-hold investor.

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ)

At the time of writing, CNQ has a 3.85% yield, a tad lower than where it was when I issued my conviction buy piece at a time when the stock sported a 4% yield, the highest yield the dividend darling has ever had.

There’s no question that there’s a barrage of issues that have plagued Alberta’s oil patch, and while it may seem like a hopeless cause today, income investors with a long-term time horizon will be able to collect their enhanced yield and consistent raises while they wait for Western Canadian Select (WCS) to find some relief.

Given CNQ is one of the most robust names in the oil sands with its healthy operating cash flow stream, management certainly has the tools to “shield” its shareholders from an industry that looks disgusting at this juncture.

Now, nobody knows when WCS will close to gap on West Texas Intermediate, but given the protection and the fat yield you’re getting, I see a very favourable risk/reward trade-off for Foolish investors who can stomach a bit of near-term choppiness.

Stay hungry. Stay Foolish.