Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ) stock is having a moment. And this moment is just beginning. This is being driven by the fact that the oil and gas industry is staging a comeback. This comeback is a function of both supply and demand fundamentals. They both point to a bullish scenario for energy stocks in 2021.

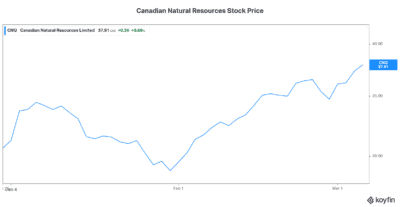

Fourth-quarter 2020 results are already giving us a glimpse of what’s to come. Please read on to find out why Canadian Natural Resources stock is up more than 25% in 2021. And why it’s a stock to buy today.

Canadian Natural Resources ups its dividend by 11%

You may have grown accustomed to receiving only bad news from energy stocks. If so, here’s a pleasant surprise for you. Canadian Natural Resources has just gone through a very strong quarter. And it’s anticipating a strong year. This optimism from energy companies is something we’ll have to get used to. Surely, we’ve all grown accustomed to the bleak and dire outlooks.

So, Canadian Natural Resources’ fourth quarter of 2020 was pretty phenomenal. This all comes together in its cash flows. Funds flow was a strong $5.3 billion for the year. Even after the company’s capital program and dividend payments, cash flow generated was strong. This free cash flow for the year was $690 million.

Think about this for a second. This is an energy company. This is the industry that many have written off. $5.3 billion in cash flow generated in 2020. It’s not something to dismiss. It is, by contrast, something that we should pay very close attention to. I mean, this kind of profitability leads to good things for shareholders.

For example, dividend increases usually follow such strong cash flow numbers. Also, analyst upgrades. Finally, increasing expectations. All of these things are happening with Canadian Natural Resources. This has led to a rising stock price. More upside is not far behind.

Canadian Natural Resources stock gets upgraded

So with this, we can see the tide turning for energy companies. As I said in my introduction, the macro environment is attractive right now. The macro environment for oil and gas includes the demand side and the supply side. It’s pretty much the classic supply/demand commodity dynamic. Less supply creates upward commodity price pressure. High demand also creates upward commodity price pressure.

RBC is calling it the next super cycle. In the last few years, investment in oil and gas production has been cut. So we are left with an attractive supply situation. In 2021, demand is expected to increase as vaccines help us gain control of the virus. It’s the perfect storm.

Expectations are rising. Analysts are upgrading Canadian Natural Resources stock. Investors are pricing this in. Canadian Natural Resources stock is surging so far this year as a result. The graph below illustrates this.

2021 outlook

It’s all about cash right now for Canadian Natural Resources. At $57 oil (it’s currently approaching $65), CNQ expects over $10 billion in cash flows. This corresponds to roughly $5 billion in free cash flow. Interestingly, a big focus on the conference call is “What will CNQ do with all of this money?” It’s very positive when a company’s biggest dilemma is their use of funds.

Some of the uses will be the typical list of things. For example, Canadian Natural Resources will continue to reduce its debt. Also, the company will buy back shares. But there’s one thing that will be a more interesting use of all of this money. CNQ is increasingly investing in technologies to work toward cleaning up its operations. The goal is to develop technologies to bring oil sands closer to net zero emissions.

The bottom line

Canadian Natural Resources’ fourth quarter was very enlightening. It’s a new world in the oil and gas sector today. We’ll see rising cash flows, rising dividends, and rising energy stock prices in 2021.